Coronavirus analysis and insights note

Setting the scene

The recent past

2019 had been a strong year for Australian tourism. Total overnight visitor spend for the year ending September 2019 reached a record $124 billion – up 10% on the year. On these figures, total overnight spend was on track to reach $134 billion by the end of 2020, just short of the $140 billion target set under Tourism 2020.

The present

Through the early months of 2020 this has all changed. Following on from the bushfires over the Australian summer, the COVID 19 pandemic is set to have a widespread and long-lasting impact on tourism.

Factors having the most damaging impact on Australia’s visitor economy are:

– Escalation of travel restrictions. The introduction of travel restrictions to visitors from China on February 1 curtailed holiday travel from Australia’s largest inbound market, and had a major impact on international education, with over half of Chinese students overseas when restrictions were brought in. These restrictions were extended to Korea, Iran and Italy through early March, prior to a global travel ban on 20 March.

– Sharp reductions in air capacity. This includes both domestic and international aviation and is an effort by airlines to reduce operating costs in response to the slow-down in demand.

– Social distancing, self-quarantining and bans on gatherings. Tourism is built on person to person interactions, and is therefore vulnerable to these dramatic changes in social behaviour.

– Restrictions on non-essential travel. Combined with state and territory border closures, these restrictions will heavily impact interstate and domestic overnight travel

Social distancing rules, staff availability, dramatic reductions in international departures and the closed borders for international arrivals have also led to the first ever suspension of the International Visitor Survey this week.

Future Outlook

The wide reaching nature of this pandemic has seen the United Nations World Tourism Organisation revising global tourism receipts sharply downward, with Asia and the Pacific expected to be the worst affected. OECD optimistically estimates a 45% tourism downturn worldwide should visitor numbers start to recover by July, and a more realistic 70% reduction should numbers recover in September.

Concerns around personal safety mean that international travel into Australia, and overseas travel by Australians will take far longer to recover. Therefore, the early stages of recovery will likely be led by domestic tourism.

Domestic visitors are however not a direct substitute for international travellers as they have very different travel and spend patterns – spending less, dispersing more, and because trips are shorter visiting fewer attractions. That said there are substantial difference in scale, with domestic overnight trips outnumbering international visits by more than twelve to one.

This will lead to substantial structural change for the industry as astute operators adapt their offerings to a different visitor mix.

Specific insights

Accommodation

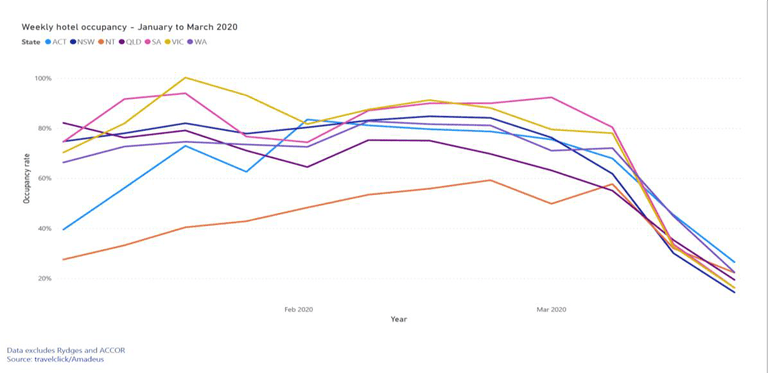

Occupancy rates have seen significant declines across all states and territories since February (fig 1).

Figure 1. Occupancy rates by state by state

Each escalation of national containment initiatives is proving to have a sharp impact on the accommodation sector. STR data shows Melbourne and Sydney occupancy rates fell from just under 50% in early March to 18% for week commencing 23 March. By comparison national occupancy rates in March 2019 were 75%.

An increasing number of hotels are going into hibernation. Most recent data (from STR) puts this figure at about 7% of establishments. Closures are skewed towards smaller, budget establishments. Some businesses were holding off decisions to close or remain open pending the latest Jobkeeper stimulus announcements.

Accor hotels have been utilised to provide isolation options for international arrivals.

Forward Bookings

Forward keys data for 16-22 March shows:

– international bookings down 291% on same week last year, the largest weekly decline to date. All 12 key markets had more cancellations than bookings.

– domestic bookings now following similar sharp descent, down 131% on same week last year. All states except WA had more cancellations than bookings.

Aviation

In response to falling demand, Qantas reduced international capacity by 90% and domestic capacity by 60% until the end of May. Virgin Australia has reduced domestic capacity by 90% till mid-June. These two airlines account for the majority of domestic aviation and one-third of inbound seats and passengers.

Anecdotal sources suggest, Qantas will now only have an Adelaide based crew of 50 compared with 90 last week and 250 in early March.

Virgin Australia have asked for a $1.4 billion federal government bailout. This has drawn criticism from Qantas CEO that help should not be offered to airlines that have been badly managed.

Businesses

In the current environment tourism businesses are especially vulnerable to shocks as they are overwhelmingly small enterprises (95% have fewer than 20 employees) and bushfires and floods impacted many economically and emotionally.

The March ABS survey of COVID-19 business impacts found that 78 per cent of accommodation and food services sector businesses have been impacted by the outbreak, and almost all (96 per cent) expect to be negatively impacted in coming months. These results are significantly higher than the all-industry average of 49% and 86% respectively.

Industry professionals (ATEC) say the uncertainty of the situation is highly challenging, and they don’t expect international visitors to return in significant numbers for at least 12 months. Consequently they are working in terms of three, six, nine and twelve month recovery stages.

High profile business closures

– 500 staff from Hamilton Island have been laid off and 300 staff from staff between Daydream and Hayman Islands have been laid off, and all islands in the Whitsunday group are closed.

– Flight Centre Travel Group are expecting 6,000 support and sales roles to be lost globally including 3,800 people in Australia who have been temporarily stood-down.

– Experience Co stood down 1080 people and accelerated divestments across the business, especially in NQ. They have been experiencing negative impacts since January, and closed down early (last weekend).

– Star Entertainment Group has stood down 90% of its workforce – 8,100 workers. Crown Casino are still investigating whether to stand people down or lay them off.

Regional impacts

All tourism regions are now being impacted by COVID-19, with isolation and the closing of domestic borders significantly inhibiting domestic travel as well.

Cairns has experienced a major downturn due to its strong reliance on China around this time of year and one of the larger hotel is running at under 10% occupancy.

The Whitsunday’s Tourism Association’s survey showed that:

– All tourism businesses have been directly impacted

– 36 businesses have suspended operations;

– 2018 jobs have been lost;

– 21,901 room nights have been cancelled;

– 13,717 tour activities cancelled;

– Total estimated value of cancellations caused directly by events so far is $122 million which includes a forecast loss of up to 30 April of $81 million